Accounting software is a crucial element for a company to succeed. Depending on the program, it can help you create professional invoices, keep track of payments sent and received, find and pursue past-due accounts receivable, streamline tax management, and run reports that evaluate the financial health of your company and project for the future.

We looked at some of the most well-liked platforms available right now in order to help you find the best accounting software for your company. We looked for cost-effective, easy-to-use accounting software that included time-saving features like automated bank feeds, payment reminders, and online invoicing and payment acceptance.

We also looked for software that provided comprehensive, scalable, real-time financial reporting because doing so is crucial for understanding and monitoring your business’s financial situation.

How Much Does Accounting Software Cost?

The features and complexity of the system can affect the price of accounting software. Pricing plans can be divided into three categories: basic, standard, and premium. The most essential features are usually included in basic plans, whereas more advanced features are usually included in premium plans. For instance, a basic accounting software plan might have tools for billing, keeping track of expenses, and financial reporting. Features like project management, CRM, and inventory management may be available in a premium plan.

The size of your business may also affect your cost. While larger businesses might need to upgrade to a more expensive standard or premium plan, smaller businesses might be able to find a less expensive basic plan.

It’s important to keep in mind that the price of accounting software can differ significantly, so it’s crucial to compare various systems and plans to find the one that works best for your company. You have two options: select a basic system and add à la carte extras like project management or CRM, or select an all-inclusive system that comes with everything you require.

Budget-conscious people can cut costs by selecting a less expensive plan, selecting à la carte options, or only paying for the features they actually use. By deciding to pay for an annual subscription, you can also save money.

How Does Accounting Software Work?

Transactions will show up in a queue once a business’s bank accounts and credit cards are synchronized with the accounting software and can then be categorized into the categories found on the chart of accounts for the company. To review profitability, compare revenue and costs, check bank and loan balances, and forecast tax liabilities, business owners can quickly run a financial report. Business owners can make critical decisions because they have quick access to this financial data.

In addition, a lot of accounting software supports the integration of third-party applications. As an illustration, if a company owner uses a point of sale (POS) system to record sales transactions, the POS system might integrate with the accounting software to record A time tracking application could integrate with the accounting software in a service-based business to add labor to client invoices.

Benefits of Accounting Software

- Time-saving: Automation features can speed up time-consuming tasks like journal entry creation and statement reconciliation.

- Compliance: A lot of accounting software packages come with tools that assist businesses in complying with regulations, like tax preparation and reporting.

- Access anytime, anywhere: Accounting software that is hosted in the cloud allows you to log in at any time, from any location.

- Integration: A lot of business applications, including CRM and e-commerce platforms, are integrated with accounting software programs.

- Error reduction: Accounting software can aid in error reduction by automating repetitive tasks and supplying real-time insights.

- It’s inexpensive: Purchasing accounting software is significantly less expensive than hiring an accountant.

- Keeps you organized: Accounting software can assist you in keeping all of your financial transactions and records in one location.

The best accounting software for small businesses, listed.

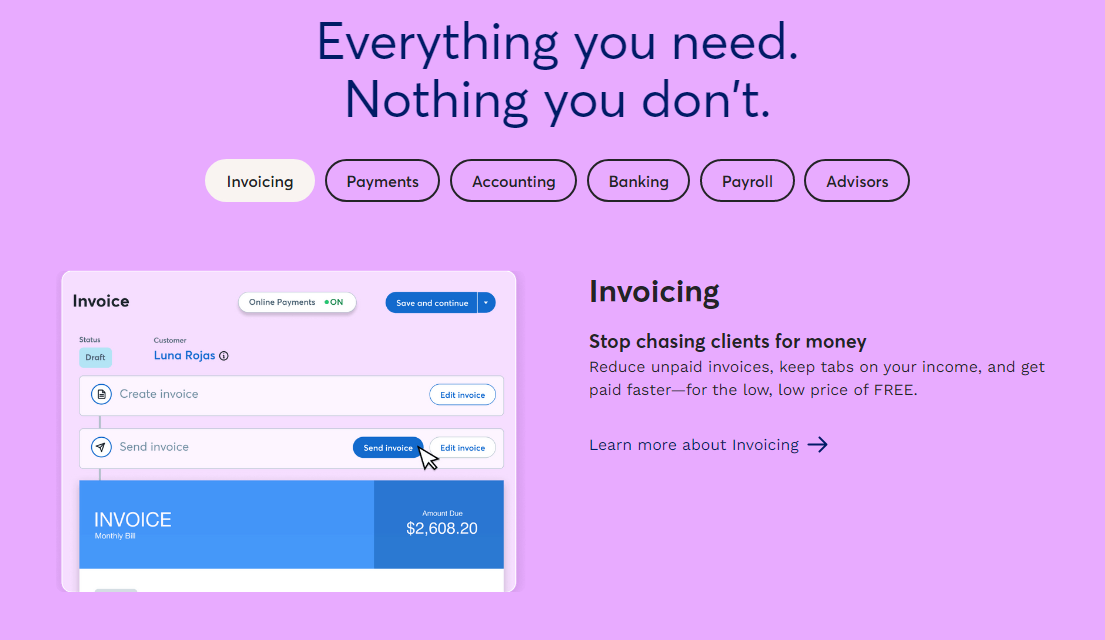

- Intuit QuickBooks Online.

For many years, Intuit QuickBooks Online was the small business accounting service to beat. It integrates outstanding user functionality with highly efficient accounting functionality. The service stands out from its competitors because it is simple to customize, has numerous versions and hundreds of add-on apps, and provides better mobile access.

Because Intuit QuickBooks Online is pricey, it’s best suited for small businesses with a budget for technology. It is feature-rich enough to allow a more demanding user to use its sophisticated accounting tools while still being simple enough for a novice bookkeeper to learn. It would be appealing to a wide range of business types because it is so adaptable and user-friendly.

2. Wave.

Unless you require payroll and payments, in which case you must pay, Wave is one of only two online accounting services that you can use without charge. It’s one of the most clear-cut and simple business services out there. It has a thoughtful selection of features for very small businesses and supports multiple currencies. However, it lacks an inventory management system, a dedicated time-tracking tool, or extensive mobile access.

Although there are better options for those businesses, integrated payroll and double-entry accounting support make it a potential choice for small businesses with a few employees. Its user interface is also straightforward, making it accessible to even financial beginners.

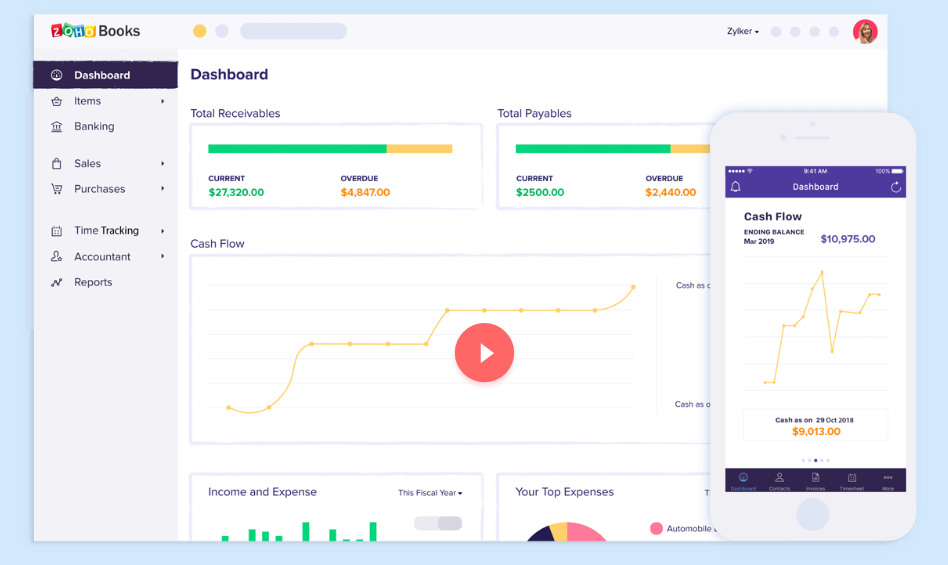

3. Zoho Books.

Your accounting data can be seamlessly integrated with a variety of related programs and services, including email, customer service, and CRM. Even though Zoho Books has a free version and is at least as capable as some of the best competitors, it is surprisingly affordable. However, this year saw an increase in price for paid plans.

Overall, however, Zoho Books is best for companies using some of Zoho’s other applications, though this isn’t the only situation where it can be useful. We also advise it to established, expanding, and small businesses who desire it for its depth, usability, and customizability. However, the breadth of its features may be overwhelming for very small businesses while being welcomed by organizations with more sophisticated requirements.

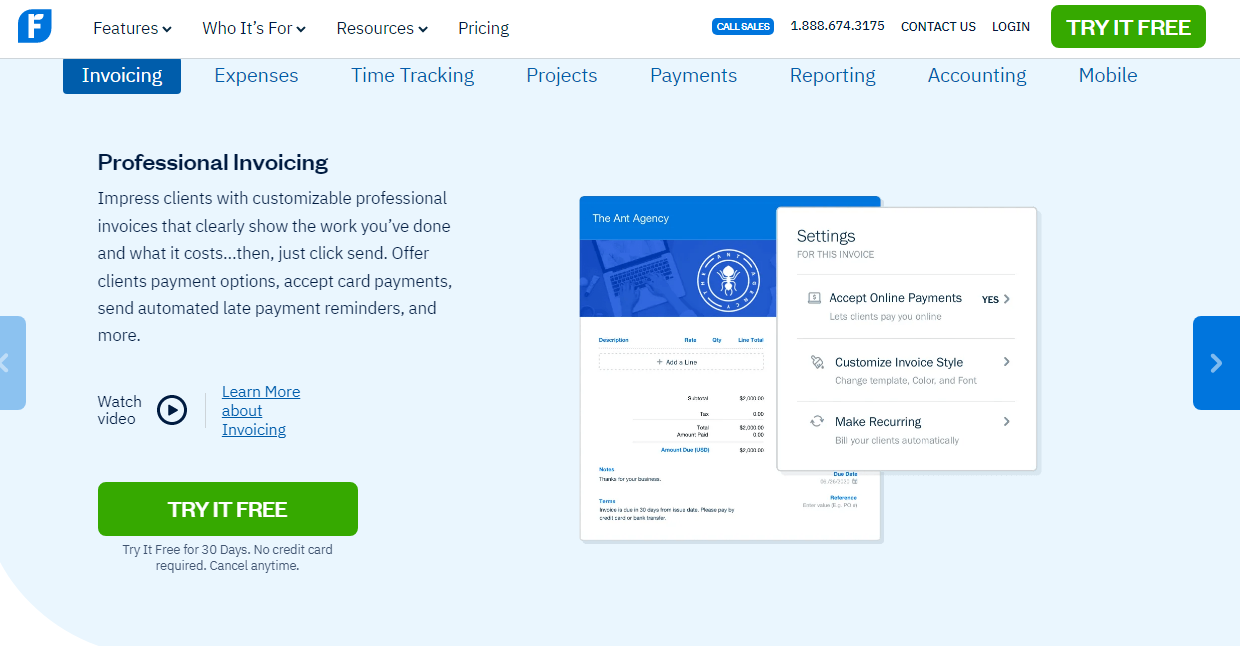

4. FreshBooks.

The attractiveness and ease of use of FreshBooks are deceiving. FreshBooks is a double-entry accounting system with a wealth of features and a top-notch user interface. For these reasons, it has received numerous PCMag Editors’ Choice awards. One of the first accounting options that a very small business should look into is FreshBooks because it’s simple enough for new bookkeepers to learn and supports all the features that a larger company would require, like payroll.

Although it can handle more, we especially recommend FreshBooks for businesses with one or two employees and sole proprietorships. It can be used by very small businesses to handle simple financial tasks like sending invoices, keeping track of financial accounts, accepting payments, and tracking revenue and expenses. Advanced tools like projects and proposals, mileage and time tracking, and reports can be added by more complex businesses.

5. Xero.

This software fully integrates with a third-party payroll service and has a simple user interface. Customers can make payments to businesses online thanks to Xero’s integration with Stripe and GoCardless.

Founded in New Zealand in 2006, Xero now has more than 3 million subscribers worldwide.

With a full-service payroll add-on, Xero offers three monthly subscription plans: Early for $12 per month, Growing for $34 per month, and Established for $65 per month.

Conclusion

Accounting software can assist small businesses with a wide range of tasks, including managing their finances, which is essential to their success. The right accounting software can make managing finances much simpler.